Seattle Foreclosure Numbers Today Aren’t Like 2008

July 28, 2023

Recent news headlines discuss the rise in foreclosures in today’s housing market, which may have caused uncertainty among those considering buying a home. Understanding the context of these reports is crucial to grasp the truth about the current situation.

According to a recent report from ATTOM, a property data provider, foreclosure filings are up 2% compared to the previous quarter and 8% since one year ago. While media headlines are drawing attention to this increase, reporting on just the number could actually generate worry for fear that prices could crash. The reality is, while increasing, the data shows a foreclosure crisis is not where the market is headed.

Let’s look at the latest information with context so we can see how this compares to previous years.

It Isn’t the Dramatic Increase Headlines Would Have You Believe

In recent years, foreclosures have reached record lows due to the implementation of the forbearance program and other relief options in 2020 and 2021. These measures enabled millions of homeowners to stay in their homes during challenging times and recover financially. Additionally, rising home values allowed many homeowners to use their equity to sell their houses instead of facing foreclosure. Looking ahead, equity will remain a crucial factor in preventing foreclosures.

As the government’s moratorium came to an end, there was an expected rise in foreclosures. But just because foreclosures are up doesn’t mean the housing market is in trouble. As Clare Trapasso, Executive News Editor at Realtor.com, says:

“Many of these foreclosures would have occurred during the pandemic, but were put off due to federal, state, and local foreclosure moratoriums designed to keep people in their homes . . . Real estate experts have stressed that this isn’t a repeat of the Great Recession. It’s not that scores of homeowners suddenly can’t afford their mortgage payments. Rather, many lenders are now catching up. The foreclosures would have happened during the pandemic if moratoriums hadn’t halted the proceedings.”

In a recent article, Bankrate also explains:

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes. Lenders weren’t filing default notices during the height of the pandemic, pushing foreclosures to record lows in 2020. And while there has been a slight uptick in foreclosures since then, it’s nothing like it was.”

There won’t be a sudden flood of foreclosures; rather, the increase stems from a combination of delayed activity and economic conditions.

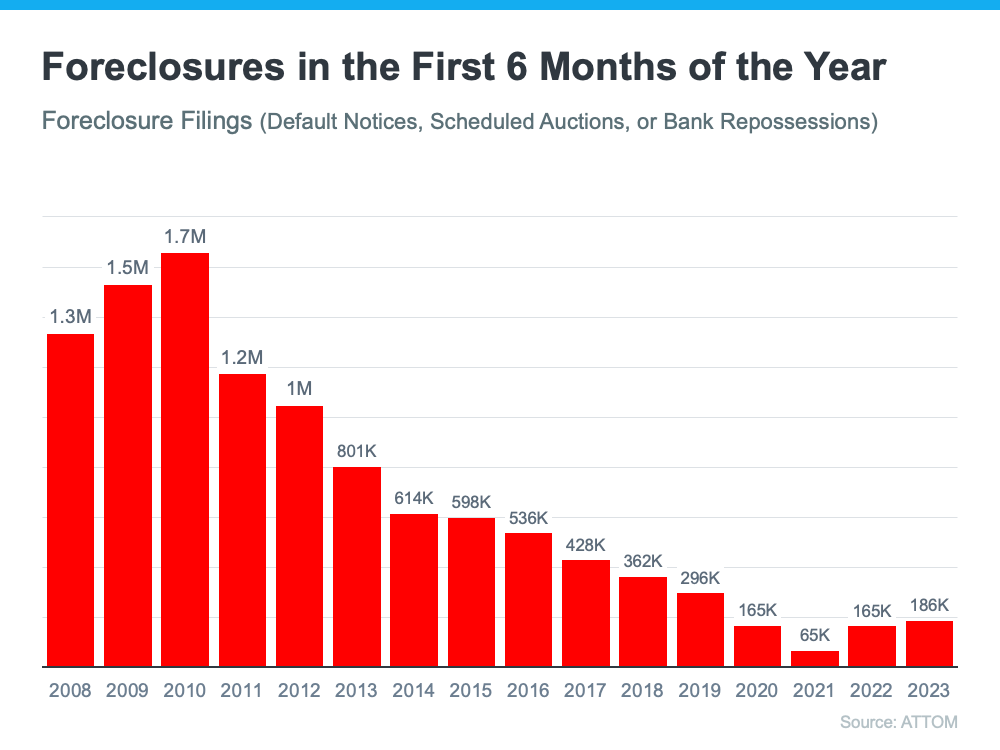

The graph below illustrates the stark contrast between the current situation and the housing crash. Foreclosure activity, measured by filings for the first half of each year since 2008, has consistently remained lower since the crash.

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was back then. Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

In addition to all the factors mentioned above, that’s also largely because buyers today are more qualified and less likely to default on their loans.

Bottom Line

Putting the data into context is crucial at this time. Although the housing market is witnessing a rise in foreclosures, it is far from the crisis levels observed during the housing bubble burst. Therefore, this increase is not expected to result in a crash in home prices.