Should Baby Boomers Buy or Rent After Selling Their Seattle Houses?

September 19, 2023

Baby Boomers contemplating selling their long-term homes face several important decisions. They must decide whether to move locally or to another state, whether to downsize or seek more space, and most significantly, whether to purchase a new home or opt for renting.

That decision ultimately depends on your current situation and your future plans. Here are two important factors to help you decide what’s right for you.

Expect Rents to Keep Going Up

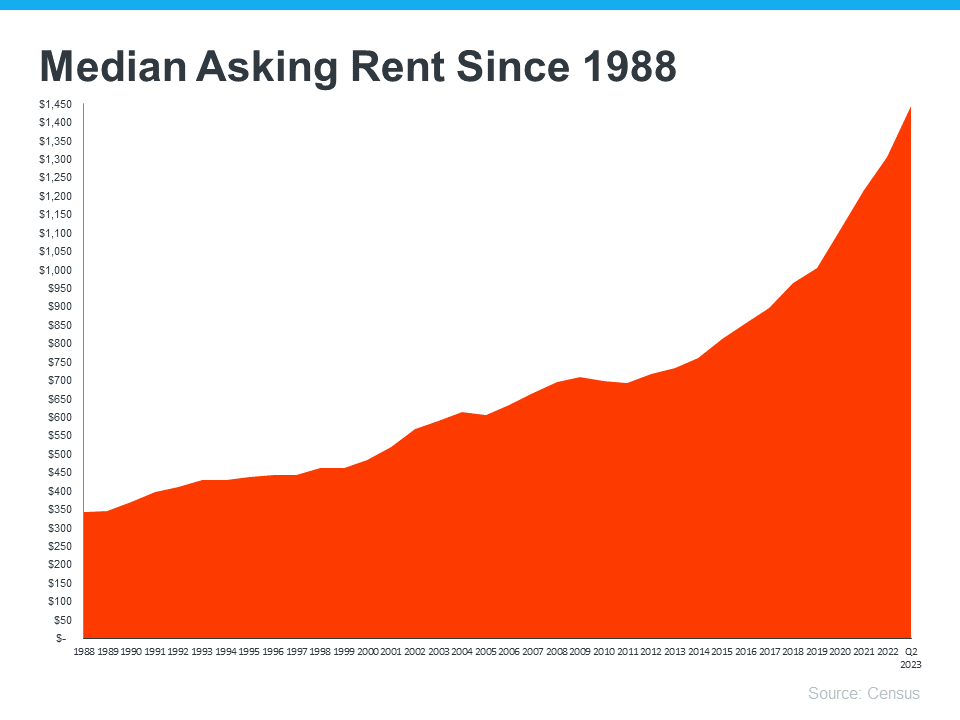

The graph below uses data from the Census to show how rents have been climbing steadily since 1988:

Rent prices have consistently increased over the years, posing a risk of higher rental payments upon lease renewal, which may not be desirable for those considering renting their next home.

Purchasing a home with a fixed-rate mortgage provides stability by locking in a consistent monthly housing payment throughout the entire loan term, ensuring predictability and steady payments over the long term. Freddie Mac sums it up like this:

“. . . homeowners with fixed-rate loans will see little to no change to their monthly housing cost over the life of their loan. You can be confident in knowing that your mortgage payments won’t change much in the long term, even when life’s other costs do.”

Owning Your Home Comes with Unique Benefits

According to AARP, buying your next home is a better long-term strategy than renting:

“Though each option has pros and cons, buying provides more pros, with a broader range of benefits.”

To assist in your decision-making process after selling your home, here are some of the benefits of homeownership highlighted in the article:

- Owning your home can help you save money for the future. Your home, and the equity you build as a homeowner, can provide generational wealth that could be passed on to loved ones, giving them a better life.

- You might not have to pay a monthly mortgage payment at all. If you have enough equity to buy your next home outright, you wouldn’t have a monthly mortgage payment. While you might still need to cover property taxes or maintenance fees, not having to worry about a monthly mortgage payment could be a big relief.

- Aging in place can be simpler. If your needs change, owning your home gives you the freedom to make renovations and updates that can make everyday life easier.

Bottom Line

For Baby Boomers contemplating whether to buy or rent their next home, it’s advisable to explore their options. Given the rising rents and the numerous advantages of homeownership, it may be prudent to consider buying their next home. Connecting with a real estate professional can help in making an informed decision.