Are Higher Seattle Mortgage Rates Here To Stay?

October 20, 2023

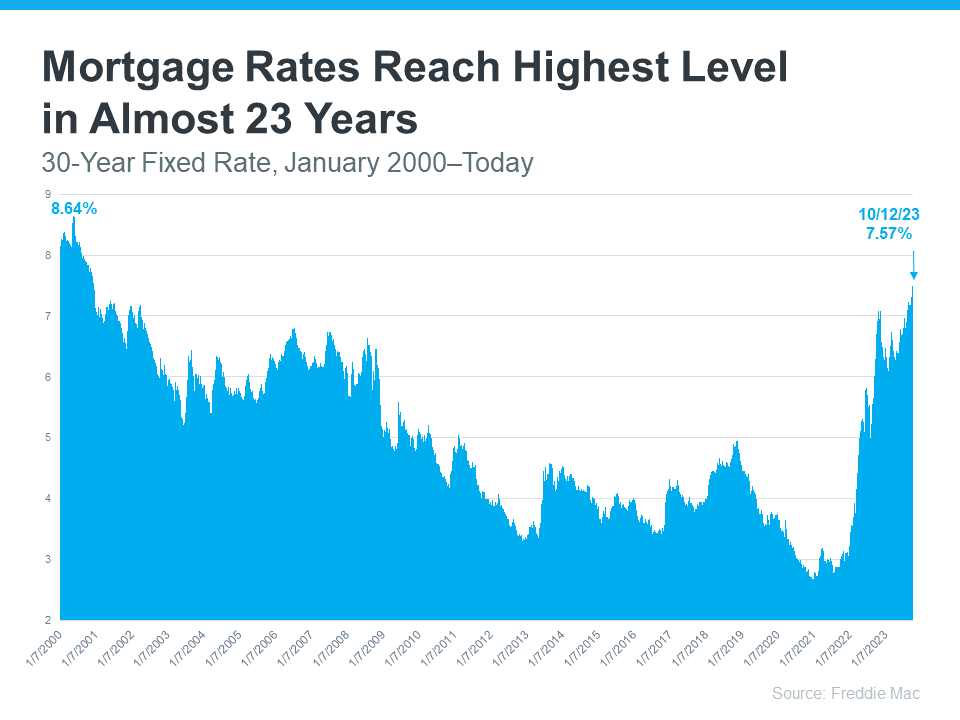

Mortgage rates have recently surged to their highest level in over twenty years, garnering significant media attention (see graph below):

The increase in mortgage rates might feel discouraging if you’re contemplating a significant decision. If you’re unsure about whether to postpone your plans, there are crucial considerations to keep in mind.

How Higher Mortgage Rates Impact You

Current mortgage rates are notably higher compared to recent years, influencing the overall affordability of homes of homes. This is due to the increased cost of borrowing money for home purchases as rates continue to rise, subsequently leading to higher monthly mortgage payments for prospective buyers.

Urban Institute explains how this is impacting buyers and sellers right now:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes . . . Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low interest rate.”

Basically, some people are deciding to put their plans on hold because of where mortgage rates are right now. But what you want to know is: is that a good strategy?

Where Will Mortgage Rates Go from Here?

Anticipating a drop in mortgage rates is a common sentiment, yet the timing of such a change remains uncertain, even for industry experts.

Although forecasts indicate a potential decrease in rates over the upcoming months, recent data reflects an upward trajectory, highlighting the challenges associated with accurately projecting mortgage rates.

The best advice for your move is this: don’t try to control what you can’t control. This includes trying to time the market or guess what the future holds for mortgage rates. As CBS News states:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Rather than trying to time the market, focus on assembling a team of experienced professionals, such as a reliable lender and a knowledgeable real estate agent. This team can provide valuable insights into market dynamics and guide you in achieving your objectives, especially if you’re facing significant life changes or transitions.

Bottom Line

The key advice for your decision-making process is to avoid fixating on elements beyond your control, particularly mortgage rates, as even experts cannot definitively predict their future trajectory. Rather, concentrate on assembling a dependable team of professionals who can provide you with valuable insights. When you’re prepared to initiate the process, feel free to reach out for further assistance.