Are the Top 3 Seattle Housing Market Questions on Your Mind?

December 6, 2023

The housing market is currently characterized by widespread confusion, with varying information from friends, news sources, and social media causing uncertainty. If you’re contemplating a move, this situation can lead to numerous unanswered questions. To navigate through this complexity, seeking guidance from a trusted local real estate agent is recommended. Their expertise can provide clarity and insights tailored to your specific situation in the ever-evolving housing landscape.

Here are the top 3 questions people are asking about today’s housing market, and the data to help answer them.

1. What is Next for Mortgage Rates?

Currently, mortgage rates are elevated compared to recent years, influencing the affordability of home purchases. The uncertainty about future mortgage rates is a concern for potential buyers. While it’s acknowledged that no one can predict with certainty, insights can be gleaned from historical trends to provide a perspective on what might unfold in the mortgage rate landscape.

Indeed, there is a well-established correlation between mortgage rates and inflation. Typically, when inflation is on the rise, mortgage rates also tend to increase. In the past year, as inflation saw an uptick, mortgage rates followed suit. However, the current scenario is witnessing a moderation in inflation. The Federal Reserve’s decision to pause their federal funds rate hikes aligns with this trend, leading many experts to anticipate a decline in mortgage rates as inflation eases.

Recent weeks have shown subtle indications of slightly lower mortgage rates. However, the mortgage rate landscape has been marked by volatility, and this trend is expected to persist into the upcoming year. While some fluctuations are normal, there is an anticipation that, by 2024, a more pronounced downward trend in mortgage rates may emerge, providing a more stable and favorable environment for potential homebuyers. As Aziz Sunderji, Strategist at Home Economics, says:

“The bottom line is that interest rates are likely to be lower-perhaps even lower than many optimists think – in the weeks and months to come.”

2. Where Are Home Prices Headed?

Contrary to concerns about a significant decline in prices, data indicates that home prices did not experience a crash this year. Instead, they are on the rise in most parts of the nation. Experts reassure that while the upward trend in home prices is continuing, it is doing so at a more moderate and normal pace for the housing market. This steadier growth is viewed positively within the real estate industry.

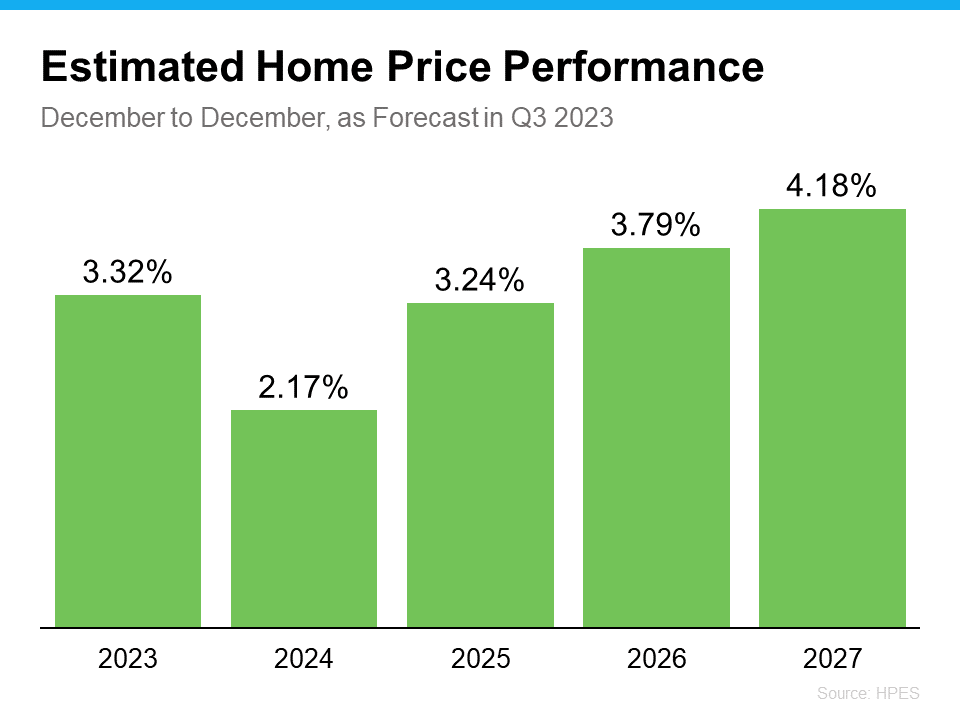

To underscore the confidence in the ongoing appreciation of home prices, the Home Price Expectation Survey by Pulsenomics is highlighted. This survey, involving a national panel comprising over 100 economists, real estate experts, and investment and market strategists, indicates a consensus that home prices will continue to climb not only in the upcoming year but also in the years to follow. The graph accompanying the survey illustrates the shared expectation of sustained growth in home prices.

3. Is a Recession Around the Corner?

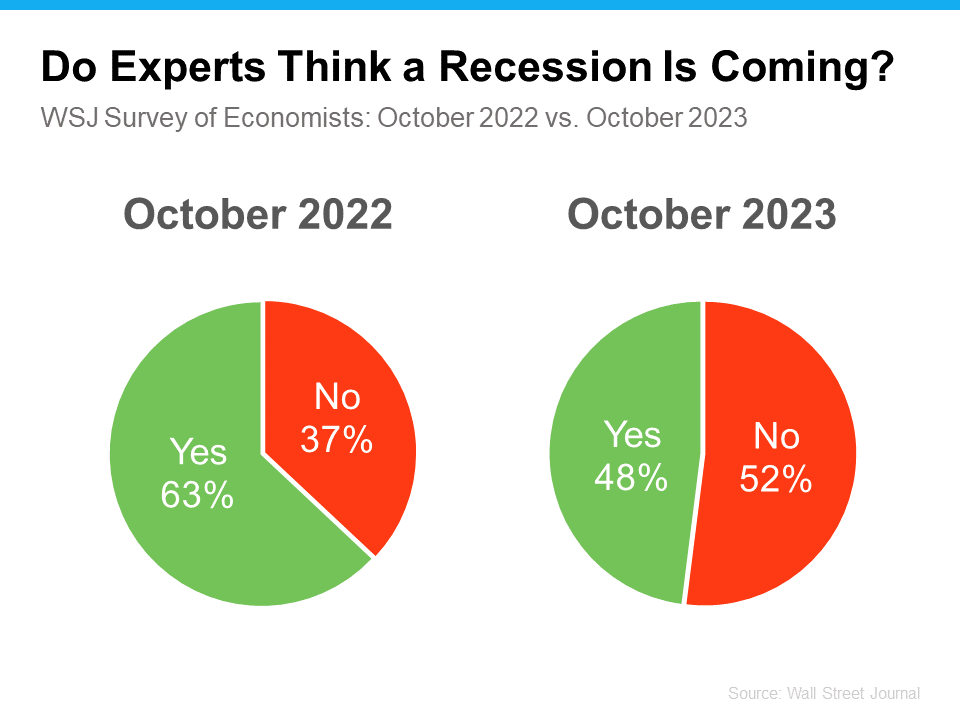

The Wall Street Journal (WSJ) regularly conducts polls with experts on the topic of a potential recession. Notably, at this time last year, the majority of these experts anticipated a recession by now. However, as experts evaluate current leading indicators, there’s a shift in sentiment, with many now changing their minds and expressing that the likelihood of a recession is decreasing. The latest results from these polls indicate a growing consensus among experts that the economy is not heading towards another recession (see chart below):

The experts’ changing stance on the likelihood of a recession is significant news for the housing market. While the 48% to 52% split might appear close to an even divide, the crucial point to emphasize is that the majority of these experts now believe that the economy has successfully avoided a recession. This positive outlook has important implications for the overall health and stability of the housing market.

Bottom Line

In summary, the key takeaway from the data is that there is no cause for concern in the housing market; instead, there are promising signs of hope. The invitation is extended to connect and discuss any housing market questions or concerns as we approach the new year, emphasizing a proactive and informed approach to navigating the evolving real estate landscape.