Don’t Let the Latest Seattle Home Price Headlines Confuse You

March 1, 2024

While you might be concerned about declining home prices based on news reports, it’s important to note that headlines often provide an incomplete perspective.

Examining the national data for 2023 reveals that home prices experienced overall positive growth for the year, although variations exist across different markets. While occasional slight declines were observed nationally in some months, they were not the prevailing trend.

The overarching story is that prices went up last year, not down. Let’s dive into the data to set the record straight.

2023 Was the Return to More Normal Home Price Growth

If anything, the previous year signaled a return to a more typical pattern of home price appreciation. To illustrate, let’s delve into the typical trends in residential real estate.

In the housing market, there are annual fluctuations known as seasonality, characterized by predictable ebbs and flows. Typically, spring emerges as the peak homebuying season, with robust market activity. This vigor often continues into the summer but gradually diminishes toward the year’s end. Home prices align with this seasonality, with the highest growth occurring during periods of heightened demand.

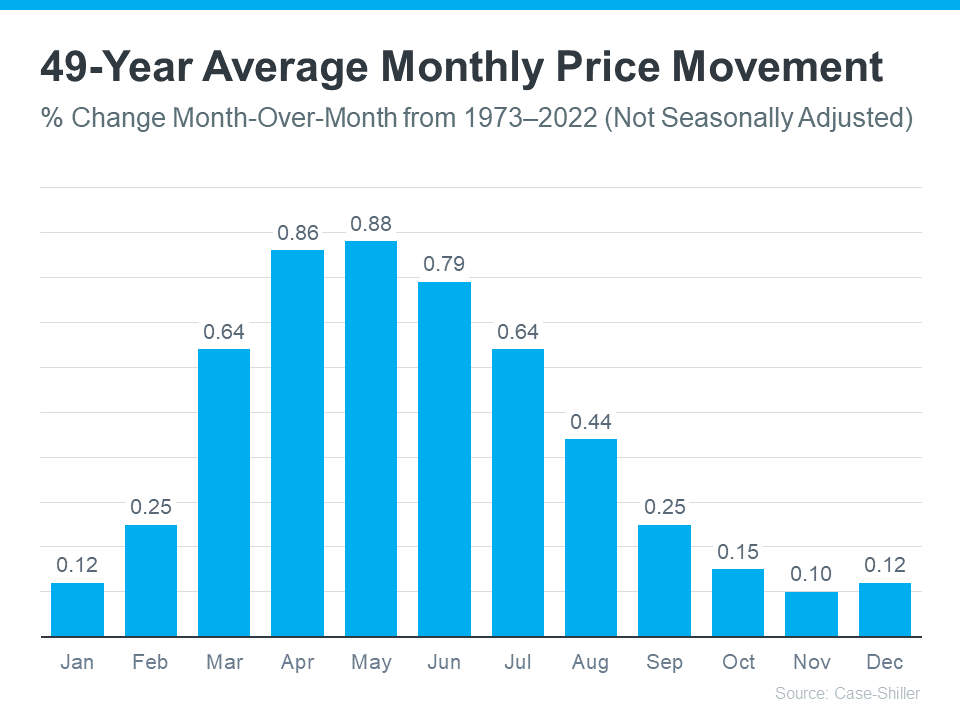

The graph below uses data from Case-Shiller to show how this pattern played out in home prices from 1973 through 2022 (not adjusted, so you can see the seasonality):

The data indicates that over nearly five decades, home prices have consistently followed typical market seasonality patterns. At the start of the year, home price growth is more moderate due to reduced market activity in January and February. As the market shifts into the peak homebuying season during spring, both activity and home prices increase. Subsequently, as fall and winter approach, market activity decreases, leading to slower home price growth.

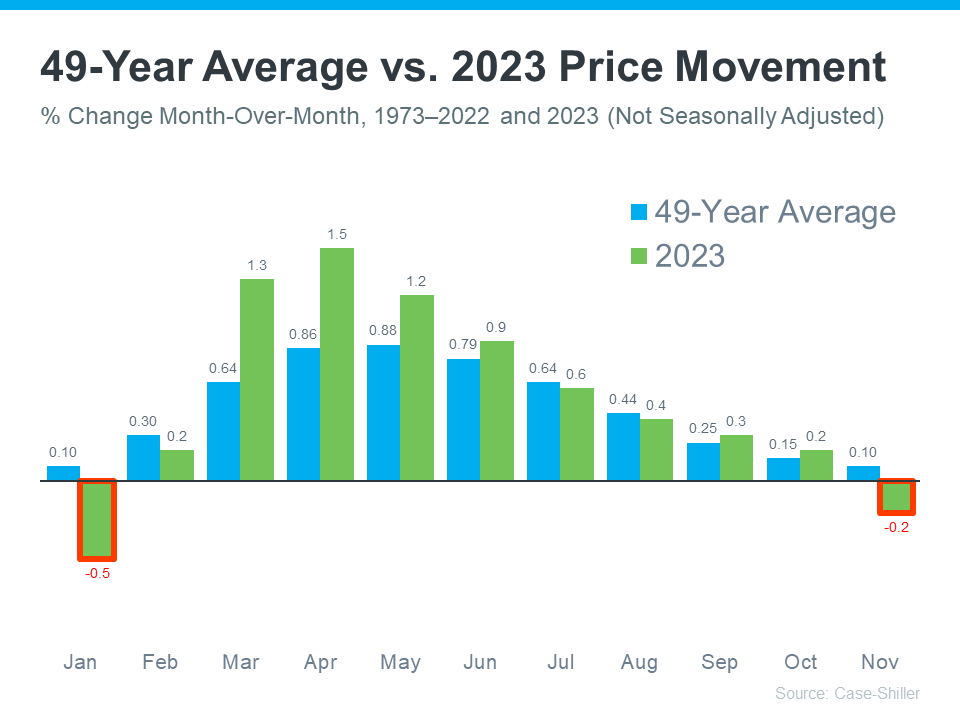

Now, let’s layer the data that’s come out for 2023 so far (shown in green) on top of that long-term trend (still shown in blue). That way, it’s easy to see how 2023 compares.

As depicted in the graph, the progression throughout 2023 aligns more closely with the long-standing trend observed in the housing market. This is evident in the convergence of the green bars with the blue bars during the latter part of the year, indicating a level of appreciation consistent with historical patterns.

However, the headlines predominantly highlighted the two bars outlined in red. It’s essential to provide context that may have been overlooked to accurately interpret these two bars. The long-term trend illustrates that it’s customary for home prices to moderate during the fall and winter months, reflecting typical seasonality.

Moreover, considering that the 49-year average is nearly zero during those months (0.10%), it’s not uncommon for home prices to experience a slight decrease during that period. However, these fluctuations are minor and temporary. When examining the entire year, home prices still exhibit an overall increase.

What You Really Need To Know

Headlines tend to highlight minor month-to-month declines rather than the broader year-long perspective. This narrow focus can be misleading as it only captures one aspect of the complete story.

Instead, it’s crucial to recall that last year witnessed the resurgence of seasonality in the housing market. This shift is beneficial, particularly after the unsustainable surge in home prices during the ‘unicorn’ years‘ of the pandemic.

For those concerned about potential decreases in home prices, rest assured that there’s no need for worry. Projections for this year anticipate ongoing appreciation in prices as buyers re-enter the market, spurred by declining mortgage rates compared to last year. With increasing buyer demand and limited supply of homes for sale, the upward pressure on prices is expected to persist.

Bottom Line

Don’t allow home price headlines to cause confusion. The data indicates that, overall, home prices experienced an increase in 2023. If you have inquiries regarding the information you’re encountering in the news or regarding the state of home prices in our local area, feel free to reach out and connect with us.