Seattle Foreclosure Activity Is Still Lower than the Norm

February 9, 2024

If you’ve noticed headlines discussing the surge in foreclosures in today’s real estate market, it’s natural to feel apprehensive about the future. However, it’s essential to recognize that these sensationalized headlines may not provide a complete picture of the situation.

In reality, when you compare the current figures with typical market trends, there’s little cause for concern.

Putting the Headlines into Perspective

The highlighted rise in foreclosures by the media can be misleading as it compares recent numbers to a period of historic lows, potentially exaggerating the situation.

During the challenging period of 2020 and 2021, millions of homeowners benefited from the moratorium and forbearance program, enabling them to retain their homes and regain stability.

Following the end of the moratorium, an anticipated increase in foreclosures occurred. However, it’s important to note that a rise in foreclosures does not necessarily indicate trouble in the housing market.

Historical Data Shows There Isn’t a Wave of Foreclosures

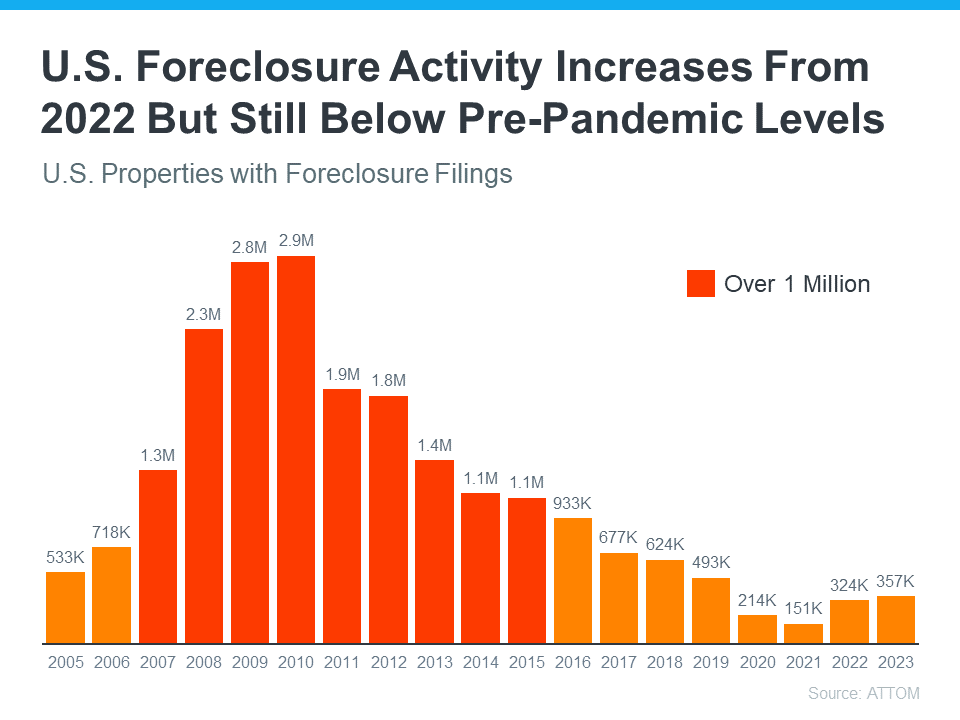

Review the graph provided below, which utilizes foreclosure statistics sourced from ATTOM, a leading property data provider, to demonstrate that foreclosure rates have consistently remained lower (as depicted in orange) since the housing market crash in 200 (shown in red):

So, while foreclosure filings are up in the latest report, it’s clear this is nothing like it was back then.

In reality, we haven’t even returned to the levels typical of more stable years, such as 2019. As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

This is mainly due to the fact that today’s buyers are more financially stable and less prone to defaulting on their loans. Delinquency rates remain low, and the majority of homeowners possess sufficient equity to prevent foreclosure. As Molly Boesel, Principal Economist at CoreLogic, says:

“U.S. mortgage delinquency rates remained healthy in October, with the overall delinquency rate unchanged from a year earlier and the serious delinquency rate remaining at a historic low… borrowers in later stages of delinquencies are finding alternatives to defaulting on their home loans.”

The reality is, while increasing, the data shows a foreclosure crisis is not where the market is today, or where it’s headed.

Bottom Line

Despite the anticipated increase in foreclosures in the housing market, it’s far from the crisis levels observed during the housing bubble burst. If you have any queries about the current state of the housing market, feel free to reach out and connect with us.