Seattle Sellers: Don’t Let These Two Things Hold You Back

August 4, 2023

Many homeowners considering selling their homes are facing two main obstacles. First, they are concerned about being tied to higher mortgage rates currently prevailing in the market. Second, they worry about the difficulty of finding a new property to buy due to the limited housing supply. However, there are ways to overcome these challenges. By seeking expert advice and exploring different financial options, homeowners can navigate the high mortgage rates. Additionally, working closely with real estate professionals and staying persistent in the search can increase the chances of finding a suitable property despite the low supply. With the right approach and support, homeowners can overcome these hurdles and move forward with their selling plans.

Challenge #1: The Reluctance to Take on a Higher Mortgage Rate

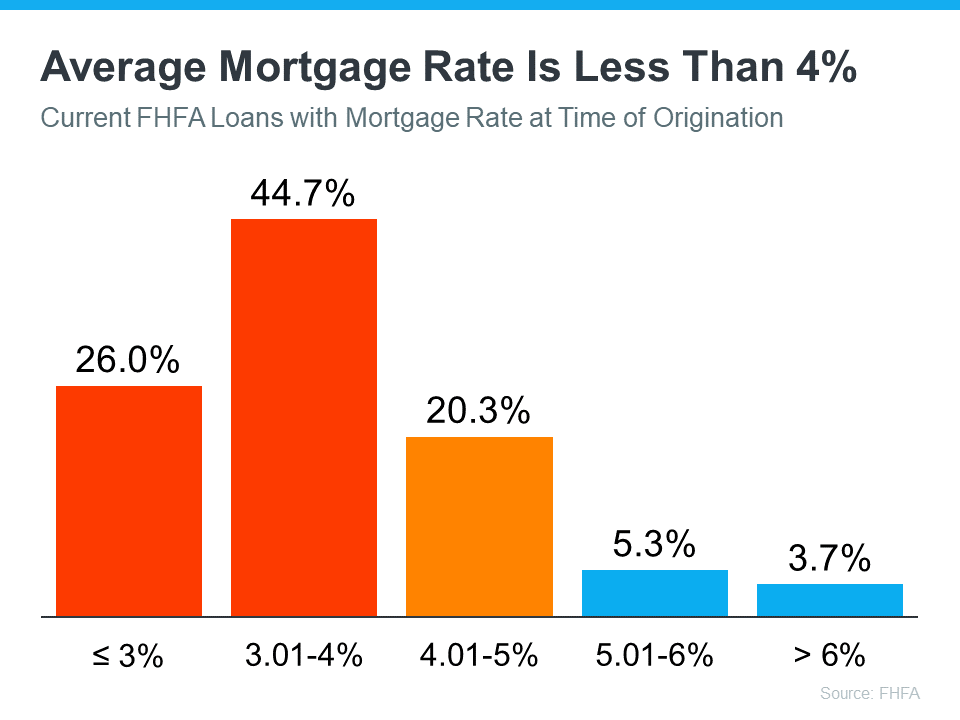

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as the mortgage rate lock-in effect.

The Advice: Waiting May Not Pay Off

Experts predict that mortgage rates may decrease gradually this year due to a cooling inflation trend. However, waiting for lower rates to sell may not be the best strategy, as predicting mortgage rates accurately is challenging. Currently, home prices are rising, so selling now would protect you from potentially higher prices when buying your next home. If rates do fall later as projected, you can always consider refinancing your mortgage. Therefore, taking action now is a prudent approach to avoid potential price increases and secure a favorable deal in the current real estate market.

Challenge #2: The Fear of Not Finding Something to Buy

When so many homeowners are reluctant to take on a higher rate, fewer homes are going to come onto the market. That’s going to keep inventory low. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Inventory will remain tight in the coming months and even for the next couple of years. Some homeowners are unwilling to trade up or trade down after locking in historically-low mortgage rates in recent years.”

Even though you know this limited housing supply helps your house stand out to eager buyers, it may also make you feel hesitant to sell because you don’t want to struggle to find something to purchase.

The Advice: Broaden Your Search

If the fear of not finding your next home is a major concern, consider exploring all housing types, including condos, townhouses, and newly built homes, to widen your choices. Additionally, if you have the flexibility to work remotely or in a hybrid model, you can explore new areas that you hadn’t considered before. Expanding your search radius and considering locations further from your workplace could offer more affordable housing options. Being open-minded and adaptable in your approach can help overcome the fear of not finding a suitable home.

Bottom Line

Instead of focusing on the challenges, concentrate on the aspects you can control. Seek the assistance of a professional with the expertise to navigate the real estate market and help you find the perfect home. By connecting with a knowledgeable professional, you can gain valuable insights and guidance, making the process of finding your ideal home much smoother and more enjoyable.