Thinking About Buying a Home in Seattle? Ask Yourself These Questions

January 9, 2024

If you’re considering buying a home this year, you’re likely closely monitoring the housing market through various channels, including the news, social media, discussions with your real estate agent, and conversations with friends and family. Home prices and mortgage rates are likely key topics dominating your attention as you gather information for your decision-making process.

Here are the two crucial questions to ask yourself as you navigate your decision-making process, along with the pertinent data that can provide clarity amidst the abundance of information in the housing market.

1. Where Do I Think Home Prices Are Heading?

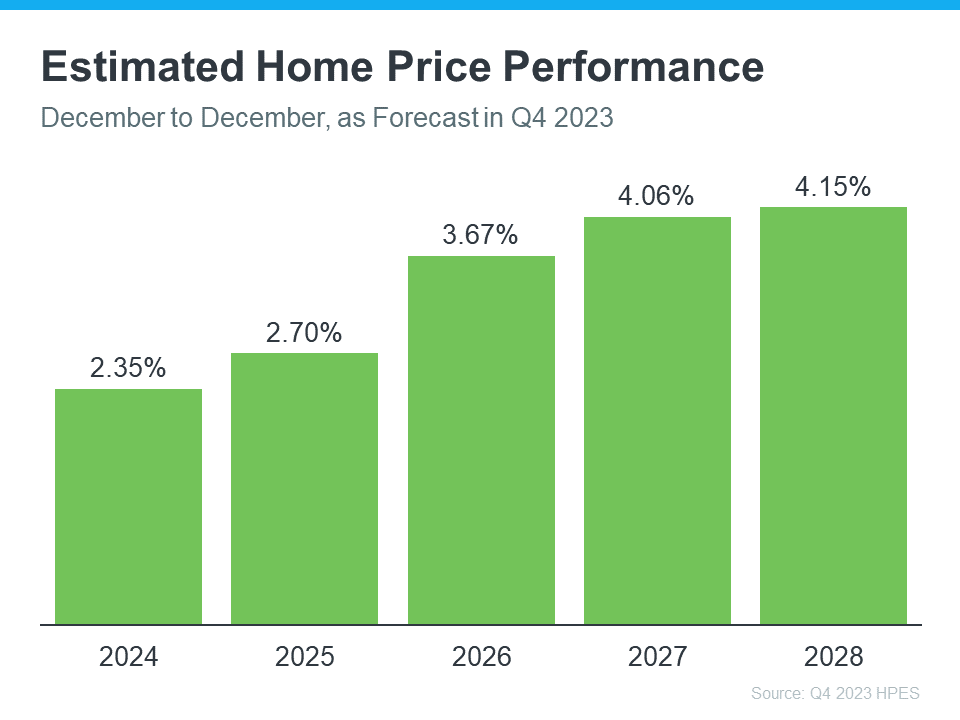

For reliable information on home price forecasts, a trustworthy source is the Home Price Expectations Survey conducted by Fannie Mae. This survey incorporates insights from over one hundred economists, real estate experts, and investment and market strategists.

Based on the latest release of the Home Price Expectations Survey, experts are forecasting that home prices will continue to rise, with projections extending at least through the year 2028 (see the graph below):

The significance for you lies in the fact that, although the percentage of appreciation may not match recent highs, the crucial point from this survey is the projection of rising home prices, not a decline, for at least the next five years. This information underscores a positive trend in the housing market.

The positive aspect of home prices rising, even at a more moderate pace, extends beyond the overall market to benefit you as well. Buying now could lead to your home gaining value and building equity in the years ahead. Conversely, waiting, as indicated by these forecasts, might result in the home costing you more in the future. This underscores the potential financial advantage of entering the housing market sooner rather than later.

2. Where Do I Think Mortgage Rates Are Heading?

In the past year, mortgage rates increased due to factors like economic uncertainty and inflation. However, there’s an optimistic development for both the market and mortgage rates: inflation is moderating. This is particularly significant for those considering buying a home, as moderating inflation tends to contribute to a decrease in mortgage rates.

As inflation cools, the typical response in the mortgage market is a decrease in mortgage rates, and this is precisely what has occurred in recent weeks. Additionally, with the Federal Reserve indicating a pause in their Federal Funds Rate increases and the possibility of rate cuts in 2024, experts express increased confidence that mortgage rates will continue to decline.

Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

As an article from the National Association of Realtors (NAR) says:

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

While absolute certainty about future mortgage rates remains elusive, the recent decline and the Federal Reserve’s decision to halt rate increases suggest a positive outlook. Although some volatility may persist, the overall expectation is that affordability will likely improve as mortgage rates continue to ease. The signs of hope on the horizon are aligned with the Federal Reserve’s stance and the recent downward trend in rates.

Bottom Line

If you’re contemplating buying a home, staying informed about anticipated trends in home prices and mortgage rates is crucial. While absolute certainty about their future trajectories is challenging, having the latest information can empower you to make well-informed decisions. Connecting with a professional in the real estate industry will ensure you stay updated on current developments, enabling you to navigate the market effectively and take advantage of favorable conditions.