Why Today’s Seattle Housing Inventory Shows a Crash Isn’t on the Horizon

October 3, 2023

The housing market today is distinct from the 2008 crash, even if you recall that event, and there is good news for those concerned about a repeat of that scenario.

A critical factor setting today’s housing market apart is the insufficient number of homes available for sale, creating an undersupply rather than the oversupply seen during the 2008 crash. A market crash typically results from an excess of houses for sale, which is not the case currently, as the data indicates a shortage of available homes.

Housing supply comes from three main sources:

- Homeowners deciding to sell their houses

- Newly built homes

- Distressed properties (foreclosures or short sales)

Here’s a closer look at today’s housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

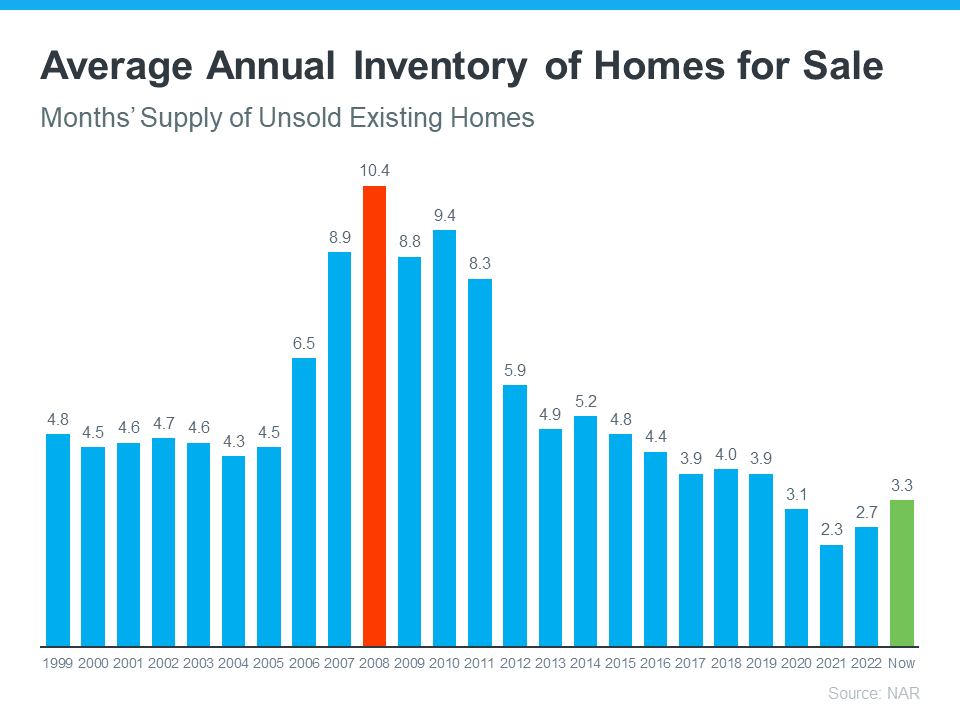

While housing supply has increased compared to the previous year, it remains at a low level. The current months’ supply of homes for sale is below the norm. A visual comparison of the latest data (green) with 2008 (red) reveals that there is only about one-third of the available inventory today compared to what was available during the 2008 housing crisis.

The shortage of available homes in the current market means that there isn’t a sufficient supply to cause home values to drop significantly. To experience a situation similar to the 2008 housing crisis, there would need to be a surplus of people selling their homes and a shortage of buyers, which is not the case at the moment.

Newly Built Homes

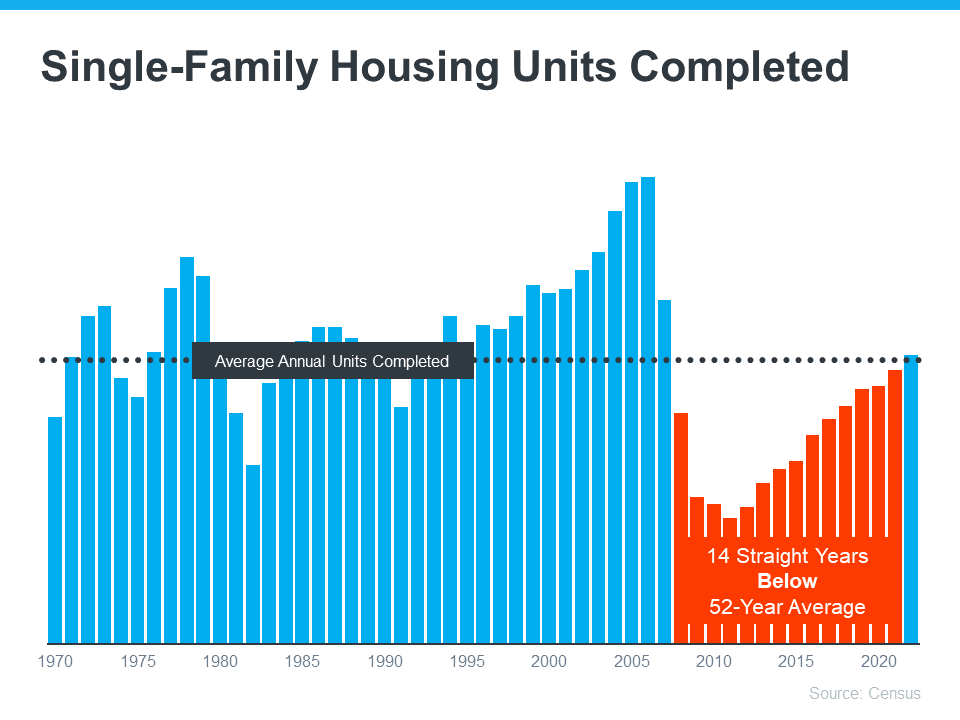

People are also talking a lot about what’s going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years:

The housing market’s current low inventory can be attributed in part to a prolonged period of underbuilding, indicated by the 14 years of underbuilding shown in red. This extended period of insufficient new home construction has led to a significant supply deficit in the market. While there are efforts to increase construction and return to the long-term average (as indicated by the final blue bar on the graph), the gap between supply and demand remains substantial. Builders are also being cautious not to overbuild homes, as was the case during the housing bubble.

Although the final blue bar on the graph indicates an increase in new home construction and a move toward reaching the long-term average, this growth won’t result in a sudden oversupply of homes. The gap between supply and demand is too substantial to be closed quickly. Additionally, builders are taking a cautious approach and are intentionally avoiding overbuilding, a lesson learned from the housing bubble experience.

Distressed Properties (Foreclosures and Short Sales)

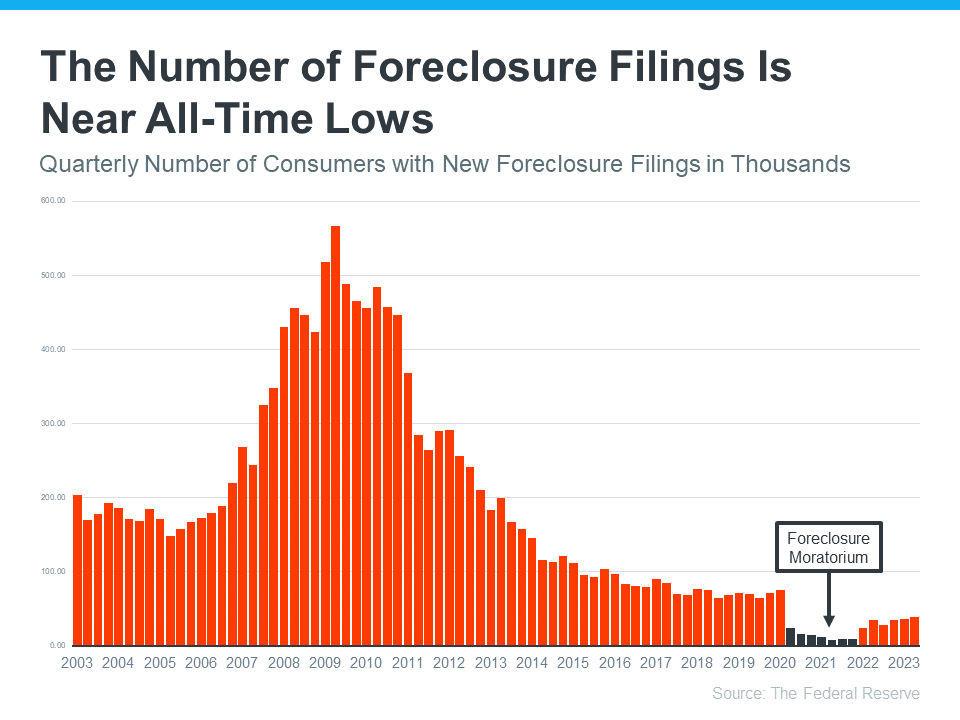

During the housing crisis, distressed properties, such as short sales and foreclosures, were a significant source of housing inventory. This was largely due to lenient lending standards that allowed many individuals to secure home loans they couldn’t genuinely afford, ultimately leading to a wave of foreclosures in the market.

In contrast to the lending standards that contributed to the housing crisis in the past, today’s lending standards are much stricter. This has resulted in a pool of more qualified buyers and significantly fewer foreclosures. Data from the Federal Reserve, as depicted in the graph, illustrates the decline in foreclosures over time as lending standards became tighter:

The graph illustrates how stricter lending standards and the qualification of buyers led to a significant reduction in foreclosures over time. Furthermore, in 2020 and 2021, the combination of a foreclosure moratorium and the implementation of the forbearance program played a crucial role in preventing a recurrence of the foreclosure wave seen during the 2008 housing crisis. These measures provided homeowners with options such as loan deferrals and modifications, helping them avoid foreclosure.

The forbearance program has been a significant game-changer, providing homeowners with valuable options such as loan deferrals and modifications that were not available in the past. Data indicates that the program has been successful, with four out of every five homeowners coming out of forbearance either paying their mortgages in full or working out a repayment plan to avoid foreclosure. These factors are among the key reasons why there is no anticipated wave of foreclosures in the current housing market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The housing market is not poised for a repeat of the 2008 housing crisis primarily because there is a scarcity of available homes, and there are no indications that this situation will change in the near future. The low housing inventory suggests that there is no housing market crash on the horizon.