Why We Aren’t Headed for a Seattle Housing Crash

March 15, 2024

If you’re anticipating a housing market crash to lower home prices, the data suggests otherwise. Experts predict continued upward trends in home prices, indicating that a crash is unlikely.

Today’s market is very different than it was before the housing crash in 2008. Here’s why.

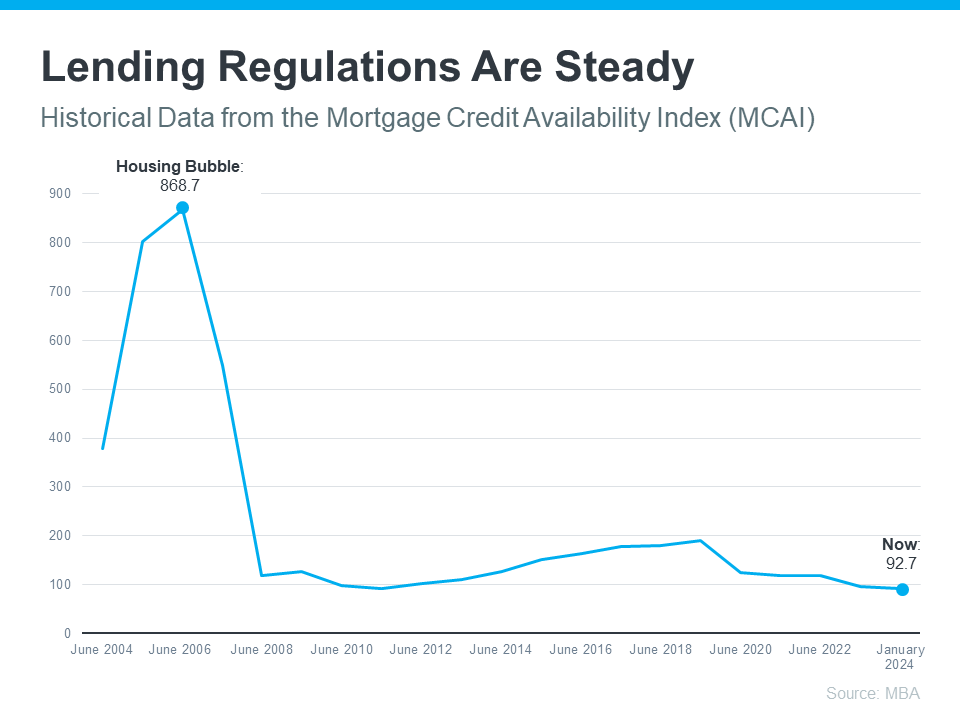

It’s Harder To Get a Loan Now – and That’s Actually a Good Thing

Obtaining a home loan was significantly easier before the 2008 housing crisis compared to today. Banks had more lenient lending standards, allowing almost anyone to qualify for a home loan or refinance.

Presently, homebuyers encounter stricter standards set by mortgage companies. Data sourced from the Mortgage Bankers Association (MBA) illustrates this shift. Lower numbers on the graph indicate greater difficulty in obtaining a mortgage, while higher numbers signify ease:

The peak in the graph indicates that lending standards were less stringent in the past compared to the present. Consequently, lending institutions assumed higher risks, leading to numerous defaults and a surge in foreclosures during the housing crash.

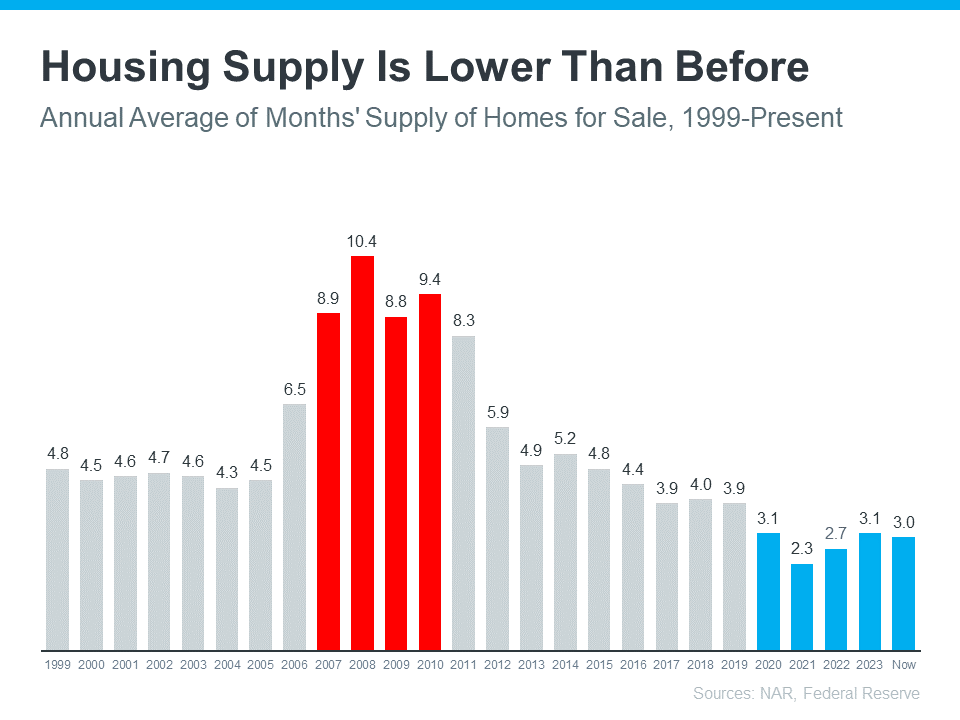

There Are Far Fewer Homes for Sale Today, so Prices Won’t Crash

During the housing crisis, an excess of homes for sale, including short sales and foreclosures, resulted in a significant drop in home prices. However, the current market experiences a shortage of inventory rather than an oversupply.

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now (shown in blue) compares to the crash (shown in red):

Presently, the unsold inventory stands at a mere 3.0-months’ supply, contrasting sharply with the peak of 10.4 months’ supply recorded in 2008. This scarcity of inventory indicates a lack of supply in the market, preventing home prices from plummeting as they did during the housing crisis.

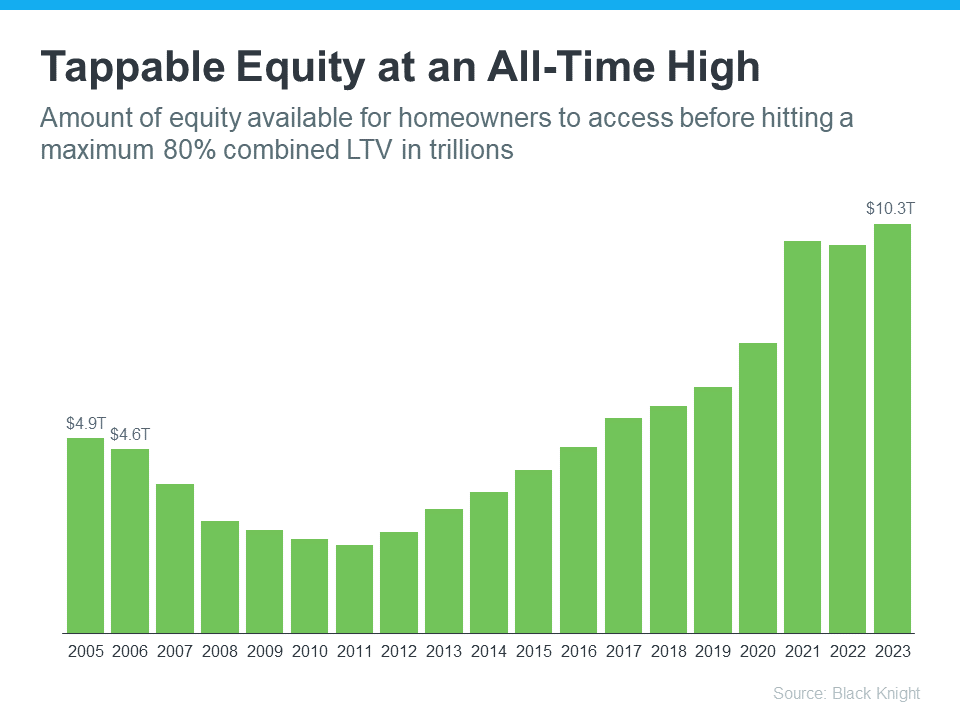

People Are Not Using Their Homes as ATMs Like They Did in the Early 2000s

Before the housing crash, numerous homeowners utilized their home equity to fund purchases like cars, boats, and vacations. Consequently, when home prices declined and inventory levels surged, many of these homeowners ended up in negative equity situations.

However, homeowners are now exercising greater caution. Despite the recent surge in prices, homeowners are refraining from tapping into their equity as extensively as they did during the previous period.

Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has actually reached an all-time high:

This signifies that homeowners collectively possess more available equity than at any previous point. This development is highly favorable, as it places homeowners in a significantly stronger financial position compared to the early 2000s. That same report from Black Knight goes on to explain:

“Only 1.1% of mortgage holders (582K) ended the year underwater, down from 1.5% (807K) at this time last year.”

With homeowners currently in a more stable financial position, they have various options to prevent foreclosure. This serves to restrict the number of distressed properties entering the market. Consequently, without an influx of inventory, home prices are unlikely to experience a significant decline.

Bottom Line

Despite hopes for a price reduction, current data indicates otherwise. The latest research indicates that today’s market differs significantly from previous conditions, suggesting that a repeat of past events is unlikely.