Your Seattle Home Equity Can Offset Affordability Challenges

September 26, 2023

If you’re contemplating selling your home, the current high mortgage rates might give you pause. Some homeowners are hesitant to sell and face the possibility of higher rates on their next home purchase. However, it’s important to recognize that despite the current rate environment, home equity is also at a significant level. This suggests that there are potential benefits to consider when evaluating your housing decisions.

Bankrate explains exactly what equity is and how it grows:

“Home equity is the portion of your home that you’ve paid off and own outright. It’s the difference between what the home is worth and how much is still owed on your mortgage. As your home’s value increases over the long term and you pay down the principal on the mortgage, your equity stake grows.”

In other words, equity is how much your home is worth now, minus what you still owe on your home loan.

How Much Equity Do Homeowners Have Now?

Recently, your equity has been growing faster than you might think. To help contextualize just how much the average homeowner has, CoreLogic says:

“. . . the average U.S. homeowner now has about $290,000 in equity.”

The rapid increase in home prices over the past few years has contributed to the accelerated growth of home equity for homeowners. While the housing market is beginning to stabilize, the demand for homes still outpaces the available supply. This continued high demand is driving home prices upward once again, further bolstering homeowners’ equity positions.

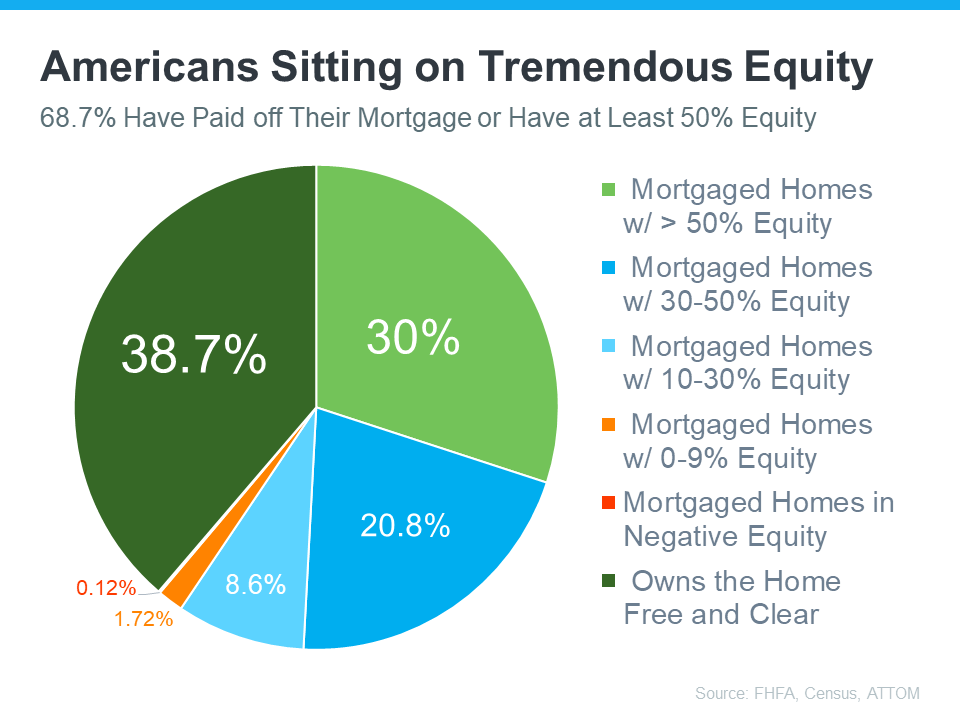

According to the Federal Housing Finance Agency (FHFA), the Census, and ATTOM, a property data provider, nearly two-thirds (68.7%) of homeowners have either fully paid off their mortgages or have at least 50% equity (see chart below):

That means nearly 70% of homeowners have a tremendous amount of equity right now.

How Equity Helps with Your Affordability Concerns

With today’s affordability challenges, your equity can make a big difference when you decide to move. After you sell your house, you can use the equity you’ve built up in your home to help you buy your next one. Here’s how:

- Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy a new house without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates. The National Association of Realtors (NAR) states:

“These all-cash home buyers are happily avoiding the higher mortgage interest rates . . .”

- Make a larger down payment: Your equity could be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much money so today’s rates become less of a sticking point. Experian explains:

“Increasing your down payment lowers your principal loan amount and, consequently, your loan-to-value ratio, which could lead to a lower interest rate offer from your lender.”

Bottom Line

If you’re considering a move, the equity you’ve accumulated in your current home can have a significant impact, especially in today’s market. To determine the amount of equity you have in your current property and explore how you can leverage it for your next home purchase, it’s advisable to connect with a real estate professional or financial advisor who can provide guidance and insights tailored to your specific situation.